FAB Balance Check Methods: Online, Mobile App, SMS, and ATM

The First Abu Dhabi Bank (FAB) is one of the largest and most trusted banks in the UAE, offering a wide range of banking services to its customers. One of the essential tasks for any FAB account holder is checking their account balance. Understanding the different methods available for FAB Balance Check can help you stay on top of your finances effortlessly.

This guide will cover various methods such as online banking, mobile apps, SMS, and ATM balance checks, ensuring you never miss an update on your account balance.

Also read: Kathleen Nimmo Lynch | Los Angeles Angels vs Cincinnati Reds Match Player Stats | Myliberla.Com Articles

1. Introduction to FAB Balance Check: Why It’s Important

Keeping track of your account balance is crucial for managing your finances effectively. Regular FAB Balance Check helps you stay informed about your available funds, avoid overdrafts, and ensure that your transactions are processed smoothly. Whether you are checking for recent transactions, verifying a deposit, or simply managing your day-to-day expenses, knowing how to perform a balance check on your FAB account is essential.

2. FAB Balance Check: Understanding the Different Methods

FAB offers several convenient ways to check your account balance, catering to the diverse needs of its customers. Whether you prefer digital methods like online banking and mobile apps or traditional ways like ATMs and SMS, FAB has you covered. Here’s a breakdown of the main FAB Balance Check methods:

- Online Banking: Check your balance anytime via FAB’s secure online banking portal.

- Mobile App: Use the FAB Mobile App to access your account details on the go.

- SMS Banking: Send a simple SMS to check your balance instantly.

- ATMs: Use any FAB ATM to check your balance with ease.

3. FAB Balance Check Online: A Step-by-Step Guide

FAB Balance Check through online banking is a straightforward and secure way to manage your account. Here’s how you can check your balance online:

How to Perform an Online FAB Balance Check:

- Visit the FAB Website: Go to the official FAB website and click on the ‘Login’ button.

- Enter Your Credentials: Input your user ID and password to access your account.

- Navigate to Account Summary: Once logged in, go to the ‘Account Summary’ section.

- View Your Balance: Your account balance will be displayed along with recent transactions.

Benefits of Online FAB Balance Check:

- 24/7 Access: Check your balance anytime, day or night.

- Detailed Information: View transaction history, pending payments, and more.

- Secure: Online banking is protected by advanced security protocols.

4. FAB Balance Check via Mobile App: Manage Your Account on the Go

The FAB Mobile App is a versatile tool that allows you to manage your finances from your smartphone. Here’s how to use the app for a quick FAB Balance Check:

Steps for FAB Balance Check Using the Mobile App:

- Download the App: Ensure you have the FAB Mobile App installed on your Android or iOS device.

- Log In: Open the app and log in with your user ID and password.

- Access Your Accounts: Tap on the ‘Accounts’ section to view your balance.

- Check Your Balance: Your account balance will be displayed on the screen.

Benefits of Using the FAB Mobile App:

- Convenient: Check your balance wherever you are.

- User-Friendly Interface: Easy navigation with a simple, intuitive design.

- Instant Updates: Receive real-time updates on your account status.

Also read: Cashstark com Success Stories | 0800 761 3372 | 127.0.0.1:57573: A Comprehensive Guide

5. FAB Balance Check via SMS: Quick and Convenient

For those who prefer not to rely on internet connectivity, FAB Balance Check via SMS offers a quick alternative. By sending a simple text message, you can receive your account balance in seconds.

How to Check Your Balance via SMS:

- Register for SMS Banking: Ensure your mobile number is registered for FAB SMS Banking.

- Send the SMS: Text ‘BAL’ followed by your account number to the designated FAB SMS Banking number.

- Receive Your Balance: You will receive an SMS with your current account balance.

Benefits of FAB Balance Check via SMS:

- No Internet Required: Ideal for areas with limited connectivity.

- Instant Response: Receive your balance immediately after sending the SMS.

- Easy to Use: No need to navigate through apps or websites.

6. FAB Balance Check at ATMs: Access Your Balance Anytime

Performing an FAB Balance Check at ATMs is one of the most traditional and reliable methods available. Here’s how you can check your balance using an ATM:

Steps for FAB Balance Check at ATMs:

- Locate an ATM: Visit any FAB ATM or an ATM with FAB services.

- Insert Your Card: Insert your FAB debit or credit card into the machine.

- Enter Your PIN: Type in your secure PIN.

- Select Balance Inquiry: Choose the ‘Balance Inquiry’ option to view your balance.

- View Your Balance: The ATM screen will display your current account balance.

Benefits of FAB Balance Check at ATMs:

- Widely Available: Access ATMs at various locations.

- Secure: Perform balance checks with complete privacy.

- No Extra Charges: No fees are usually associated with balance inquiries.

7. Benefits of Regular FAB Balance Check

Maintaining a habit of regularly checking your balance has several benefits that can enhance your financial management:

- Prevent Overdrafts: Avoid unexpected fees by ensuring you always have enough funds.

- Monitor Transactions: Keep track of recent transactions to spot any unauthorized activities.

- Plan Your Finances: Knowing your balance helps you manage your spending effectively.

- Peace of Mind: Stay informed about your financial status to reduce stress and uncertainty.

- Instant Alerts: Receive real-time updates on your account activity.

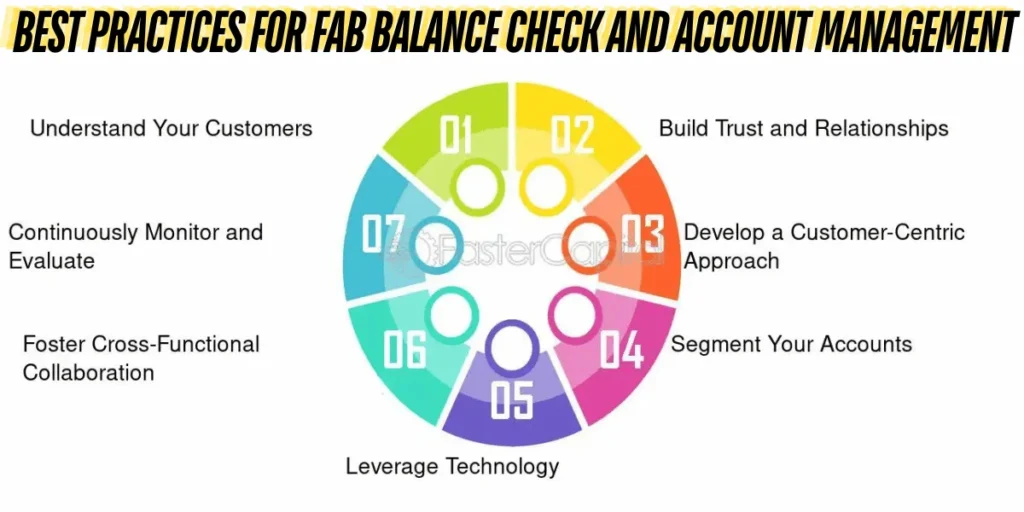

8. Best Practices for FAB Balance Check and Account Management

- Set Up Alerts: Enable balance alerts to receive notifications of low balances or significant transactions.

- Use Secure Methods: Always use secure methods like online banking or the FAB Mobile App for your balance checks.

- Update Your Contact Details: Ensure your phone number and email are up-to-date to receive account updates promptly.

- Regular Checks: Perform regular FAB Balance Checks to stay on top of your financial health.

Also read: BigTechOro | Crane Rental Prices Per Day And 6 Factors Affect Rental Cost Blog.Sentigum.Com | Petpooja Dashboard Login

Conclusion

Performing regular FAB Balance Check is an essential part of managing your finances. With various methods available, including online, mobile app, SMS, and ATMs, you can easily stay informed about your account balance. Each method offers unique benefits tailored to your convenience, ensuring you can always access your financial information whenever needed. By integrating these balance check methods into your routine, you can better manage your spending, avoid overdrafts, and maintain control over your financial health.

Frequently Asked Questions (FAQs)

Q1: Can I perform an FAB Balance Check without internet access.

Yes, you can use the SMS banking service or visit any FAB ATM to check your balance without needing internet access.

Q2: Are there any fees associated with FAB Balance Check methods?

Generally, there are no charges for balance checks via online banking, mobile app, SMS, or ATMs. However, it’s always best to confirm with your bank.

Q3: How can I register for FAB SMS Banking?

You can register for SMS Banking by contacting FAB customer service or visiting any FAB branch.

Q4: Can I check the balance of my FAB credit card using these methods?

Yes, you can check the balance of both your FAB debit and credit cards using online banking, mobile apps, SMS, or ATMs.

Q5: What should I do if I face issues during a FAB Balance Check?

If you encounter any issues, contact FAB customer support or visit your nearest branch for assistance.